I made money a few years ago when I sold a software company, and financial advisors, stockbrokers, yacht brokers, and real estate agents came out of the woodwork. It made my head spin (and my wife’s, too) as we patiently listened to pitches, looked a glossy brochures, and tried to make sense of our new set of circumstances.

Some of these guys were promising a great rate of return, but most were just in it for the management fees that went along with handling the portfolio. Some had a lot of experience, and some were just going to sign us up and have more seasoned pros in their office actually make investment decisions.

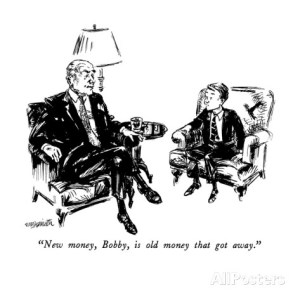

We went with an older guy, after a couple of sleepless nights. He was referred to us by a college buddy who, in retrospect, I now realize had family money from “back when Moses was an altar boy,” as my dad used to say.

When I saw your column, I thought about “in their own words” and I remember what my buddy told me: “You just need an income, a lump sum, and then some.” When he broke it down like that, all the annuities, dividend stocks, REITs, deferred this and all that just became really simple. I’d sold my company, so I didn’t have a salary. So I needed investment income. I had a lump sum, so I just needed to preserve that. And then some, I guess my buddy meant a little something extra on the side of the lump sum.

We chose the investment advisor because he told us to go slow and only do what we were comfortable doing with the portfolio. He also had experience with other new rich people who still managed to keep most of their money.

So, that’s my story. An income, a lump sum, and then some. Old money, in their own words. – Cliff

Byron shares Cliff and Cliff shares his story. This blog just improved, which I thought couldn’t be done. Thank you both.

Thanks, Anglosphere. Glad you enjoyed. – BGT

I appreciate the conservative investment style suggested. These days I hear everyone talking about this or that high flying investment without even mentioning high P/E ratios. I never sold a software company but I have an active income. As long as that is in place for me I want to protect my lump sum. My savings rate from my active income plus interest from my lump sum is my “then sum”. Informative and insightful as always Byron. Thank you Cliff for sharing.

Thank you, Dario. Sounds like you’ve got a solid formula and a solid plan. – BGT