In The Old Money Book, I talk about the importance of prioritizing Financial Independence: stacking up savings and investments before spending money on consumer products. Of course, this is not always easy. The cost of living seems to outpace salary increases. Kids need braces on their teeth. Automobiles need repairs. Houses need maintenance. Uncle Sam is a little insistent that we pay our taxes.

What’s more, by the time many of us do set a little money aside, we often feel like we deserve a little reward for ourselves, something enjoyable to give us a little motivation to get up Monday morning and start the whole work process over again.

That ‘reward’ is one spending scenario. As long as our ‘reward’ is within budget, these little treats don’t usually impact our financial progress very much. This is especially true when we tie rewards to accomplishments, which we recently discussed. (And Dario gets a new watch! Congratulations!)

A bigger problem is when spending money becomes a compulsion or an addiction that a person cannot control. According to Megan Hull, an editor for the Recovery Village treatment center in Florida, medical terms for this include oniomania, compulsive shopping, compulsive buying behavior, compulsive consumption, and pathological buying.

She also notes that it affects about 5% of the American population. That sounds like a small amount until you do the math and realize that about 16 million people in America may be suffering from a shopping addiction, crippling hopes for their children’s education or a worry-free retirement.

The results are predictable…and alarming. Almost 60% of spending addicts have oversized debt to income ratios. More than 40% can’t make their monthly payments on a regular basis, much less pay off their debt completely. One third experience criticism from friends family about their spending, contributing to guilt and depression. 8% encounter ‘financial’ legal problems because of their spending (lawsuits and collections). And another 8% find themselves insnared in some sort of ‘criminal’ legal problem as a result of overspending.

Sadly, women make up 92% of all compulsive shoppers.

If this was a health crisis making 16 million people physically sick, we’d have Dr. Fauci announcing a nationwide campaign to provide access to treatment and protocols for prevention. But because it’s only wrecking the financial health of Americans–and benefiting big retailers–the problem receives little attention and practically no remedial support from the private or public sectors.

In fact, says Ms. Hull, shopping addiction was removed from the Diagnostic and Statistical Manual of Mental Disorders, the standard manual of psychiatric and psychological disorders, in 2013. Therefore, it is not officially recognized as a mental health disorder. The condition’s removal was mostly attributed to the lack of research into a shopping addiction. The move caused significant controversy among health care professionals because compulsive shopping has all the features of what they call a ‘process addiction’. This is an addiction based on ‘behavior’, not just ‘substances’ like alcohol or drugs.

So everybody’s ignoring this, or sweeping it under the rug. Well, I guess that’s why I’m here, for just such an emergency.

Doctor Tully to ER. Doctor Tully to ER.

Seriously, this is an issue I’ve seen afflict friends and family members. It’s difficult for most people to admit because they can continue to function–work, have a family life, hang out with friends–unlike some who suffer from drug addiction or alcoholism.

Plus, it’s more than socially acceptable. It’s socially encouraged. Furthermore, nobody knows you’re suffering from it until your credit cards get canceled, your car gets repossessed, your house gets foreclosed upon, you go bankrupt, or you have to ask friends or family for money.

It is difficult to detect, and even more difficult to confront someone with their problem. Spouses can hide purchases from each other. Some people feel it’s their ‘right’ to spend ‘their’ money any way they want (a dangerous rationalization.) The resulting debt can take years to accumulate and, thanks to minimum payments, the spending problem can go on for decades as long as you can make payments or get more credit cards. Don’t even think about the amount of interest that accumulates in the process, making it even more unlikely that the debt will be paid off.

So how do you handle this addiction? Predictably, I’ve got a few suggestions.

First, destroy your credit and debit cards. Cut them up and throw them away. If you need to buy something, you will have to go to the bank during business hours. You will have to withdraw cash. You will then have to pay cash for what you want or need. The end result of this will be that you will be incredibly inconvenienced..and eventually incredibly aware of what you spend every dollar on. Eventually, you will return to using a debit card and maybe a credit card, but you will have learned how to use them in a healthy manner.

Second, put your credit cards in a plastic container. Fill that container with water. Place that container in the freezer. If you have something you feel you absolutely must purchase on credit, you will have to get the container out of the freezer and let the water thaw before you can use your credit card. If your car has broken down and you need to repair it, this is just an inconvenience. If you’ve just seen a great deal on a video game console online, this is a time-out to think about it…and pass on it.

Speaking of online, spend less time on the internet. Spend less time watching television. Meditate. Walk. Do yoga. Read a book. Buy some sparkling water and peanuts and invite friends over. Avoid the boredom and lethargy that lead to going to the mall–or going online–and shopping for things you don’t need. Note that most people with shopping addictions shop alone, online.

Third, substitute the purchasing of consumer products and purchase assets instead. As an example, I know a woman who used to have–I kid you not– a steamer trunk full of beauty products. Lipsticks, mascara, foundations, blushes, eye shadow, beauty creams, hand creams, wrinkle creams, body lotions…you name it, she had it, in quantity if not quality. Some of it she’d use. Most of it simply sat in the trunk, unopened. All of it she purchased online.

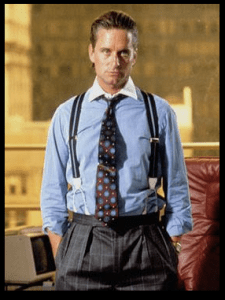

A friend of hers saw the trunk open one day and quipped, ‘Good god, D—-, if you’re going to buy things all the time, buy stocks. At least you’ll have something to show for it a year from now.’ Surprisingly, the offhanded comment stuck. D—- now gets her ‘retail therapy’ by researching and finding her ‘stock of the week’ that she’s going to buy, signing into her online brokerage account, and buying two, six, or twenty shares of stock that she can afford and that she thinks are likely to increase in value. Now, she’s investing in cosmetics companies instead of buying the products sold by cosmetics companies. She’s joined online investor groups where she interacts with other would be Gordon Gekko’s. She’s is learning, engaged, and alive, rather than bored, isolated, and depressed.

Fourth, keep shopping…just buy cheap things and pay cash. As many of you know, I live in Paris and I’m now stranger to nice things. I enjoy the occasional shopping spree. Most people do. It’s a social experience that you do with friends and family. You explore new boutiques, discover new products or services, and hopefully find something that’s going to add to your overall quality of life. But if you’ve got a shopping problem, this presents a problem.

One option is to avoid online shopping and march off to your local Salvation Army, Goodwill, or thrift store. Here, second hand clothing, housewares, toys, and books–anything, really–is on sale in varying states of condition, for pennies on the dollar. You can find Ralph Lauren shirts for 5 dollars. You can find food processors for 10 dollars. Some items look like they’ve been attacked by a Rottweiler. Some are new with tags and have never been used.

The important thing is not what condition the items are in, but rather what level they’re priced at. You can have the same ‘rush’ that you feel buying something here that you do when you click online and pay retail. The only difference will be that you’ll save yourself hundreds if not thousands of dollars. Furthermore, when you realize that you’ve filled up your closet with second-hand, thrift store items, you can be carefree and guilt-free, knowing that you only spent 3 dollars for that blouse, five dollars for those pants, and 10 dollars for that jacket. It makes donating them back to the thrift shop that much easier, too.

Getting offline, out into the world, and going to a thrift shop to look for things to buy can be a viable way to do damage control if you or someone you know has a spending problem. But it’s a temporary fix.

The real work will be to address the emotional issues that are driving your spending, and that’s rarely a quick or clean process. If you need help, click HERE and talk to some professionals. Reach out to a trusted friend or family member and get some get support. Find someone you can turn to before you get online, browse, click, and buy without thinking.

Work hard. Make money. Enjoy nice things. But put the people in your life and the goals in your life before the shopping in your life.

- BGT

Thank you Papa!

JanB

Yes!

My sister actually taped her credit cards up in painter’s tape. If she wanted to spend more than she had in cash she had to be willing to humiliate herself in public by spending 3 minutes at the cashier’s desk unwrapping her line of credit. She ended up dipping into her credit once while she was paying down her debt to cover an emergency visit to the vet for her dog.

This post really strikes a chord with me (and not just because of a shout out 😉). I have relatives that have shopping addictions that have evolved into a hoarding addiction. Buying cheap can exacerbate the issue with hoarding and has had a metamorphosis into a “donate everything you just bought to Goodwill even with the tags on it” addiction. It is one of the reasons I am personally obsessed with the Old Money lifestyle…because it is the only cure for this kind of horrible addiction. The pain of knowing how much family wealth was squandered so recklessly is hard to imagine and can make a person sick. OMGs need to focus on inner strength and the money will flow, and most importantly….stay put for the next generation.

Several months ago, I opened a brokerage account at the same establishment where I already had my IRA. I’ve been reading/studying/learning about investing, and have bought some individual stocks, and some mutual funds. It’s a different kind of thrill—one that I believe will bring better results in the long run. I’m planning on at least 10 years here. I’ve not destroyed or closed any credit cards, but have instead managed to pay them off and not use them further. It’s a good feeling to have that sense of control!

I agree, Katie. If you want to buy something, buy stocks. Plus, if you buy stocks they might generate enough income for you to buy . . . more stocks!

Thanks, Amy! so true–reinvest those dividends! The pandemic has put the kibosh on real shopping, and there’s a limit to what one can shop for online. Using the extra money to open a brokerage account . . . well, going back through family papers, I see that this is what my ancestors did: invest. And a late favorite aunt had her standard line: Thou shalt not touch the principal.

Very good posting, given recent event with the pandemic I didn’t realize that this was still an issue. Remember buy quality and take care of it. I dress nice, but my wife made note that the clothes I wear are at least 20 years old. Nice and soft and still presentable. The first Christmas after my marriage my wife gave me a Gloverall duffle coat. I said whew, now I no longer need to think about winter coats (not buying another). My wife who is also a CPA loves sewing, I can always look forward to a homemade quilt or comforter for my Birthday. Here are some tips we use:

Plan your purchases and run the numbers in your budget spreadsheet before making any purchase.

Make a grocery list and just make your meals from scratch. If you eat out do it old school, once in a while, make a reservation at a good place with a limited menu.

Purchase toothpaste, dental floss, mouth wash, deodorant and shampoo once a year in bulk. (Prevent high dental bills).

Choose fixing over new.

Cook like grandma and grandpa. No gadgets.

Get the lowest tier internet possible. “Sorry son you can’t down load that expensive game because the internet in our area is slow, now go outside and play”

Cut the cord. Let’s bring back free TV, if you have time to watch.

Check to see if your library offers Canopy a free streaming service with good movies.

Finally get turned on by something: Gardening, learning an instrument or even restoring an old car. The more time you spend learning on you own the less time you will be wasting money or thinking about spending. (Used instruments are inexpensive now-a-days)

I enjoyed reading your post and especially its timely and valuable lessons for all generations (i.e. the … now go outside and play… part.) Thank you! JanB